GOOD “MOAR”NING TRADERS-

…And then we see, then we see, then we see.

I actually think at some point within the next two years, FED changes their inflation mandate from 2% to 3%. I just think that that happens. Okay?

Let's get started.

Good morning, good morning, everybody. SPX was up 37 last I seen. What is it? Okay, so I have up 37 here. 5154. Right back up. 5154. 5172. 5192. 5209. Downside 5100 and 5050.

AVGO 0.00%↑ . This is week three. We told you. Three weeks, it doesn't do anything. I mean, it just fascinates me when people start saying, ask me, can I buy BROADCOM? I just laugh. I said, four to six weeks. And they're like, but, you didn't tell me, can I buy it? I said, four to six weeks. Don't buy it. It doesn't move. It won't move. It doesn't. It doesn't. It doesn't. Okay?

NVDA 0.00%↑ . 909, 937, big number. If 937 goes, you got 972. Okay? Underneath, you got 850.

ADBE 0.00%↑ will be off screen. Adobe will be off screen after today. Okay? Because it's not going anywhere. It's dead. It's dead. It has a big issue.

ASML 0.00%↑. If NVIDIA guides way up and they like it, ASML back to 1,000 very fast. Okay? So I actually like the thousands here. They're very, very interesting. Let's see. Let's see. Let's see.

LRCX 0.00%↑ , same thing. If NVIDIA guides up, this can really accelerate. If POWELL were to cut, Lam Research is at 1020. And ASML is at 1050. I don't think hes going to cut, but you got to be aware. Okay? Be aware. Okay? Under 952.

CVNA 0.00%↑ , 83 91.

PANW 0.00%↑ , 286, 291, 309. But we haven't heard much from the Palo Alto CEO if they're giving away free software, is it working? Isn't that interesting?

AMD 0.00%↑ , 196, 206.

MSTR 0.00%↑ , all about Bitcoin. If Bitcoin gets through 73,000, it's going to go up to 2,000. Okay? Now, here's the thing on MicroStrategy. And I think the shorts that got burned this week, here's what they don't understand. Let's say MicroStrategy has 200,000 Bitcoin. You times it by the amount of Bitcoin it is, and that should be the market cap. But their market cap, which was like 3 billion higher, is now 5 or 6 billion higher. They say the MicroStrategy market cap keeps going up. I mean, that's why I'm going to go short it.

But he can come out and issue a billion dollars worth of convertibles and buy more Bitcoin. And he can do that every other week. And he can easily raise $10 billion more to add $10 billion more Bitcoin. So then his market cap goes higher. It doesn't cost him anything. So all the shorts that got destroyed by buying Bitcoin and shorting MicroStrategy because they think we'll get massacred, this is a GME 0.00%↑ type of move. If he does that every two weeks, if he were to just come out and say, we're going to raise money and we're going to buy Bitcoin every two weeks, it probably goes to 3,000.

Now, I don't think he's going to do that, but he could. And that destroys every one of these funds because they try to make sense of stuff. If you've seen that movie Dumb Money, oh, short this. It's going to go down tomorrow or next week. They've got to obliterate it. This logic they have for MicroStrategy is wrong. Real valuation doesn't matter if you can issue as much stock as you want and it doesn't cost you anything on a convertible. So just understand that.

COIN 0.00%↑ , 272, big number.

META 0.00%↑ , finally starting back up again. Can we get through 503? If NVIDIA's good, through 503 goes to 520.

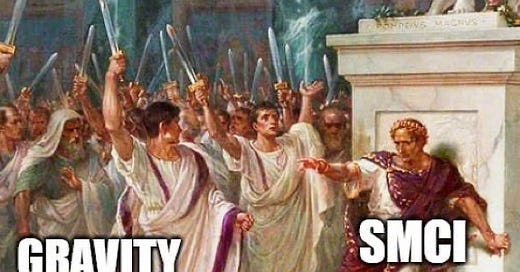

SMCI 0.00%↑ , nice pop back up, but now not supported by SPX. If NVIDIA were to go down to 850, SMCI's probably back at 950. If NVIDIA goes to 1,000, it's probably through 1,200.

CMG 0.00%↑ , is it near high of year? I mean, very near high of year? Looks like 2,800.

NOW 0.00%↑ , huge move to 791 and failed again. So do we go back there again, 791. And do we go back there again? Then we see…

MSFT 0.00%↑ very strong Thursday, Friday, and now weaker. I believe they were strong because they were adding it to the SPX on a percentage basis, but they're not now.

TSLA 0.00%↑ big move, seven, eight points up. Seven, eight points up on a price hike. First price hike.

And then we see, then we see, then we see.

Okay?

That's what we know, that's what we know.

Everybody have a great day. See you in chat.

Levels were shared in the newsletter as well as in our daily chat below. Join us in the chat and in to trade with us for FREE!SLACK

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more. Me, “TRADING101” and this newsletter is not affiliated with Samir Parikh, SmarterTrading411.com, or with the SP Executive Services LLC., whatsoever.

Share this post